-

ĐÀO TẠO – DỊCH VỤ

-

TIN MỚI NỔI BẬT

-

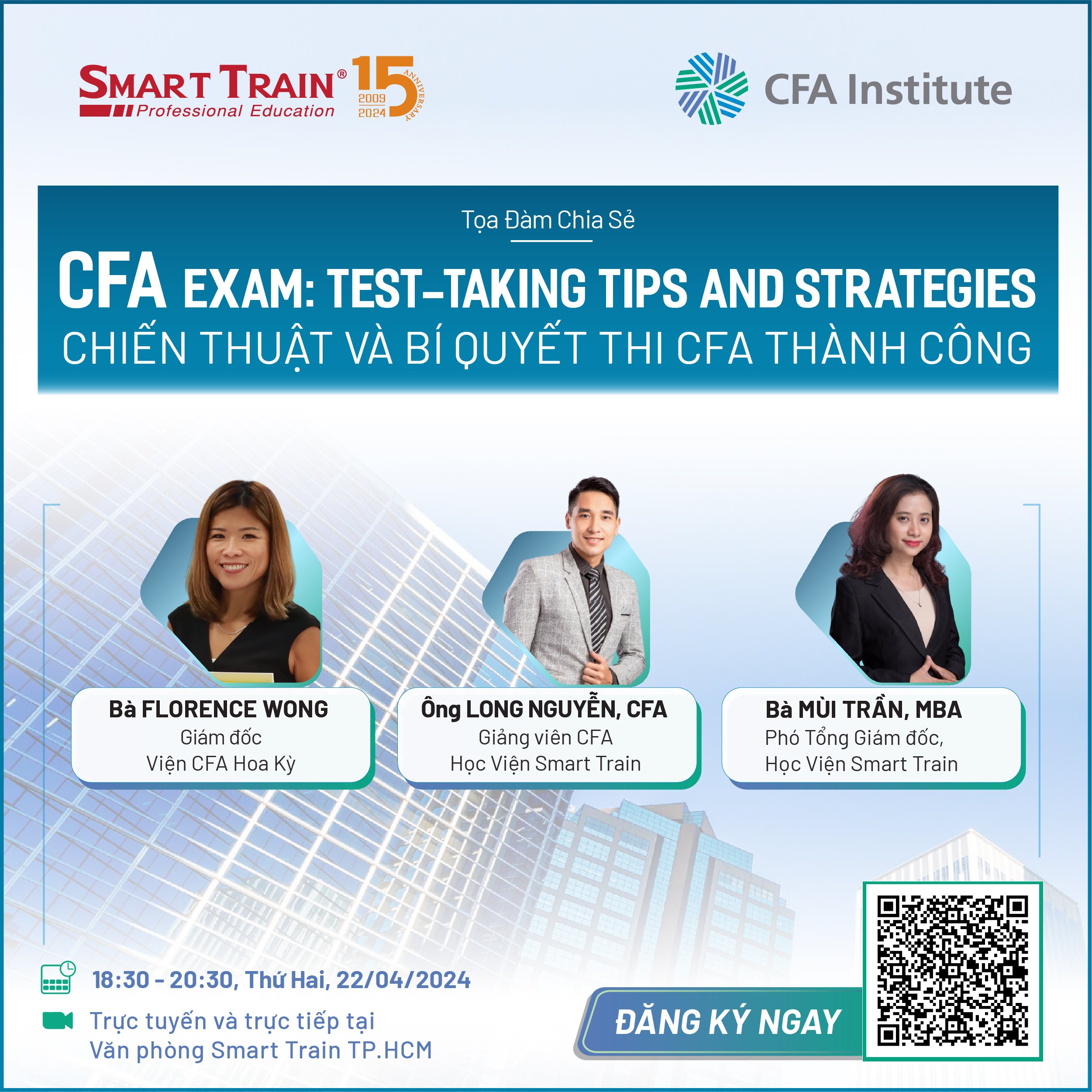

22/042024Tọa đàm “Chiến thuật và Bí quyết thi CFA thành công – CFA Exam: Test-Taking Tips & Strategies” [18h30, 22/04/2024, Hybrid]

Địa điểm: Trực tuyến và trực tiếp

-

24/042024

-

20/042024

-

18/052024

-

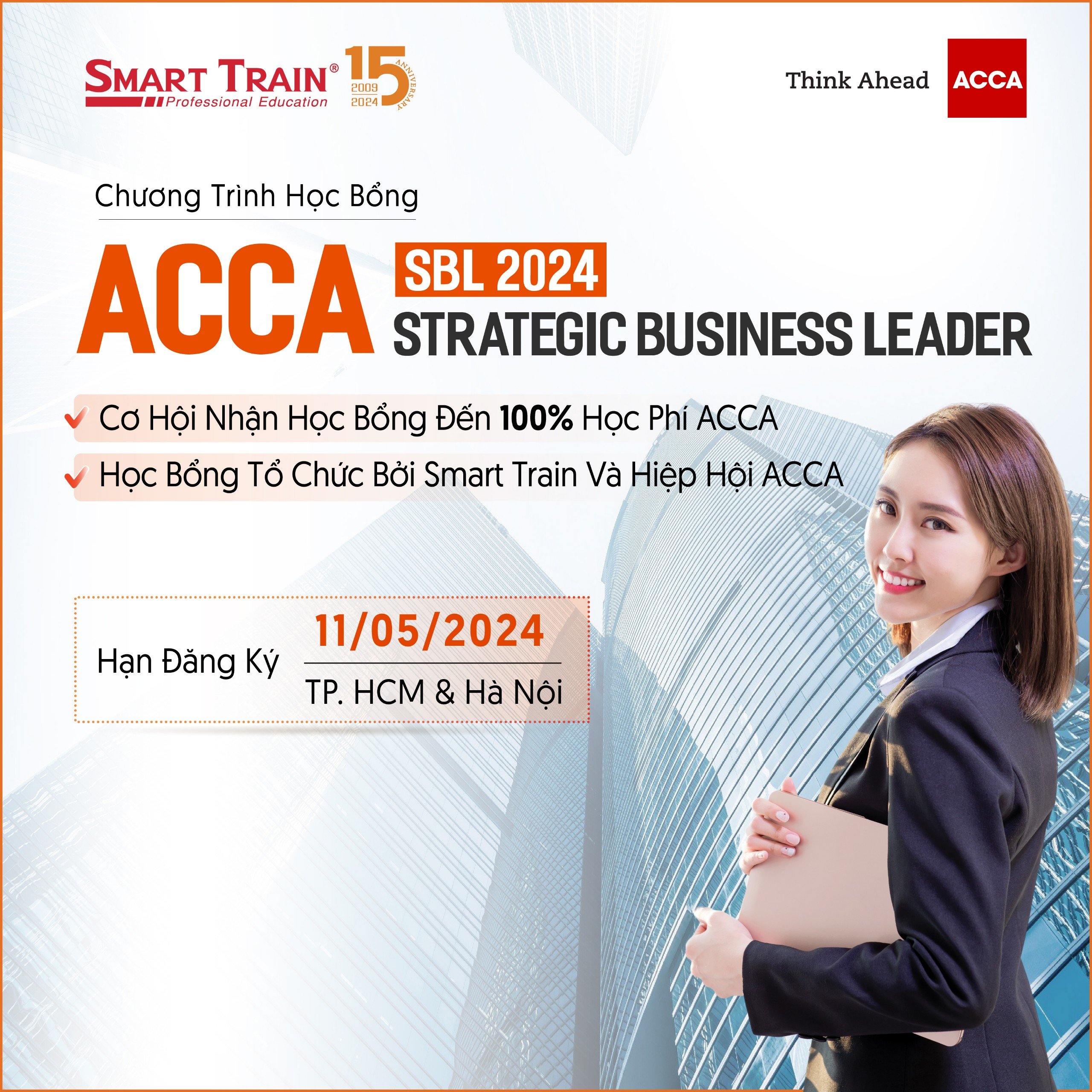

11/052024

-

04/052024

CẦN THÊM THÔNG TIN? CHÚNG TÔI Ở ĐÂY ĐỂ HỖ TRỢ BẠN